Turnarounds and Crisis Management

As a contrast to restructuring projects (being dominated by balance sheet redesign including changes in ownership and financing structure), turnarounds focus on operational redesign: cash generation, cost reductions and profit improvement, reorganization, refinancing and strategic redirection. Handling an immediate liquidity crisis in a high-risk situation is a typical starting point.

Read this article on: Strategic Alliances and JV Partnerships.

Turnarounds are also characterized by the necessity of quickly building trust among a larger (than for a typical restructuring) set of key constituencies, including employees and labor unions (in addition to owners, creditors and banks/corporate lenders).

Turnarounds Have Two Sets of Agendas

Turnarounds usually have a double agenda: Handling a short-term liquidity crisis and cost reductions without significant impacts on strategy and structure, while dealing with a deeper set of priorities. This second agenda can involve irreversible changes to corporate design, product offerings, factory structure and core business units. The deeper agenda is actually a restructuring, but one with clear operational characteristics (for example, through the redesign of a sales or manufacturing organization).A Turnaround Represents Irreversible Change - Requiring Consistency

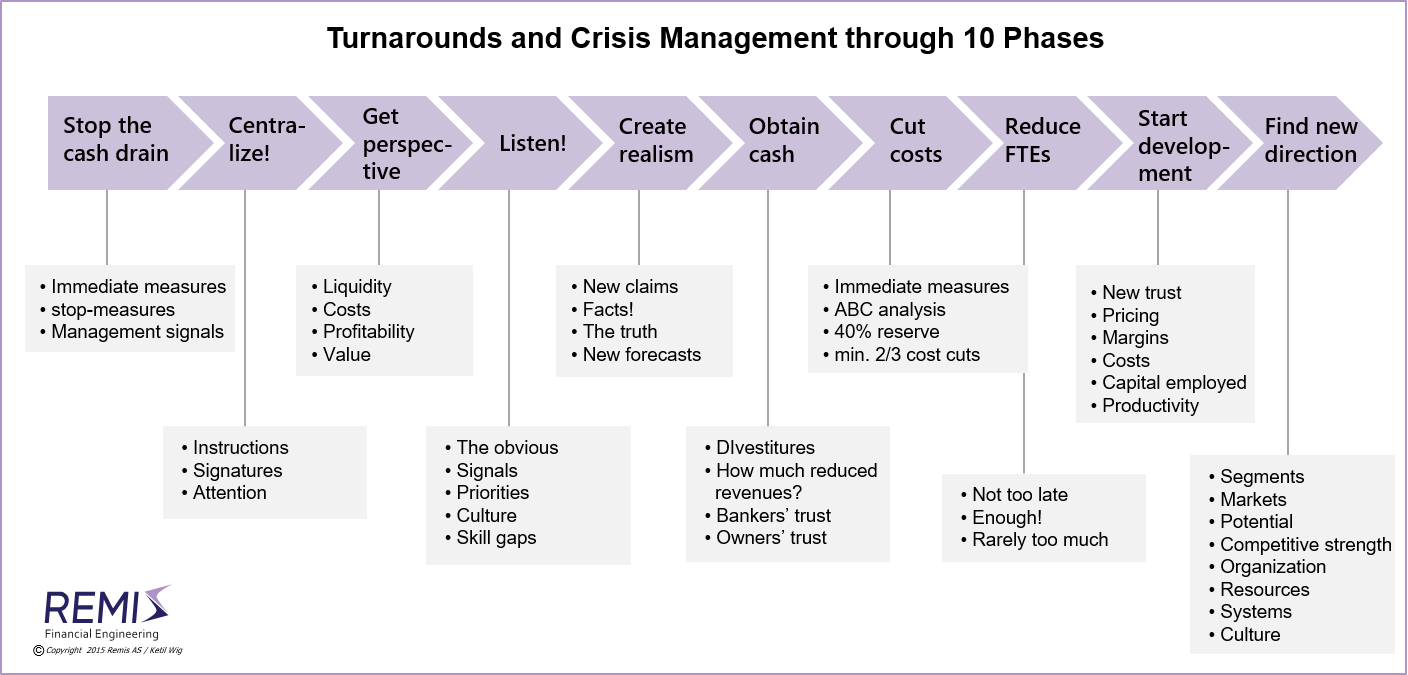

The below illustration shows a 10-step model for managing a turnaround situation.

As the restructuring part of a turnaround normally represents an irreversible change of strategy, a critical skill of the turnaround team is the ability to set the business on the "right track" in order to ensure consistency between the short-term focus and the building of long-term corporate value (see strategy).

Other Relevant Articles

Also read the separate articles on

Strategy Implementation and the Lack of Results, on

Strategy and the Proper Use of M&A Tools, on

Buy-Side M&A, on

Sell-Side M&A, on

Synergies and Poor Judgment, on

Financial vs. Industrial Ownership, on

Developing High Quality Business Models; on

Equity Based Financing of Start-ups, and on

M&A Process Management.

See Download Center:

White Paper #1:

Post-Merger Integrations - About Synergies and Poor Judgment;

White Paper #3:

Strategy and Implementation - and the Lack of Results;

White Paper #5:

Buy-Side M&A (mergers and acquisitions);

White Paper #6:

Sell-Side M&A (divestitures, trade-sales and mergers); or

White Paper #7:

Should You Choose Financial or Industrial Investors/Owners?;

White Paper #8:

Equity Based Financing of Start-ups and High Growth Situations; or

White Paper #9:

A 15 Step Recipe for Developing Your High-Quality Business Model.