An Algorithm for Developing Your High-Quality Business Model

The road from «promising idea» to «qualified business case» is paved with well-intended guesses and imprecise advice. Here is a more accurate way of how to develop a quality business model.

This article is available in a full pdf version.

The focal point of a business model is the «formula» for how to make revenues and profits.

A «formula» means that the outputs are predictable as a function of the inputs!

That formula is not the «canvas». A business canvas (in whatever version it is used) is a great tool for ensuring consistency between the different parts of a company’s value chain or between constituencies (e.g. customers vs. suppliers). That consistency check is what many (old-school) business plans are missing.

But a canvas doesn’t tell you how to find the formula ...

... and a precise prescription for that search is exactly what most business development frameworks are lacking.

The core of high-quality business modelling

The search for a high-quality business model starts with applying a well-defined logical recipe to the following four business plan elements:- Target Groups

- Value Proposals

- Pricing

- Channels

The core of business modelling is to iterate between these 4 elements in order to arrive at a stable and early conclusion of what is to be delivered (the value proposal) to whom (the target groups) for what concessions (the pricing) and in what way (the channels).

The figure below illustrates the key connections of business modelling between de 4 mail elements: target groups, value proposals, pricing and channels.

This early understanding of the basis for developing the profit formula then forms the foundation for the remaining elements of the business plan, e.g., cost structure, skills, resources, etc. Using this approach, the cost structure is not an input factor – it is rather an output consequence; i.e., the understanding of the business model sets the preconditions for the cost structure.

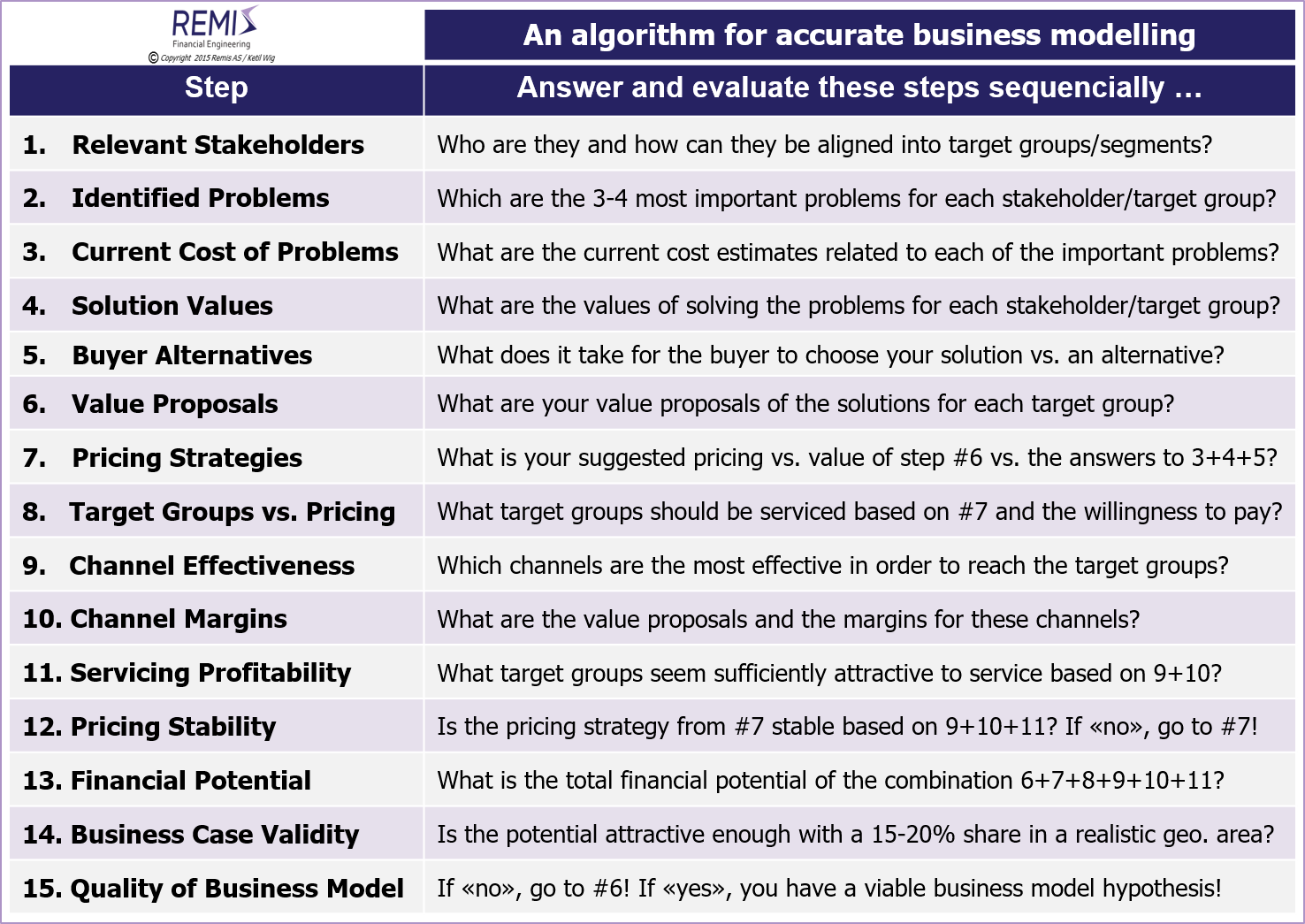

The table to the right illustrates a 15 step «algorithm» for developing a high-quality business model – and ... for avoiding the pitfalls.

Try this recipe:

Step 1. Who are the relevant stakeholders and target groups?

The challenges start right here due to the mixing of buyers, users, decision-makers, influencers, etc. All relevant stakeholders must be part of the picture of who benefits and who loses. The value proposal shall then create winners and neutralize losers. But first you must capture the basic underlying facts.Here are 3 cases from 3 different incubators over the last 12 months:

- A new venture is launching an app for the automatic handling of travel expenses; but what is the «deliverable» to the company controller?

- A new platform is linking bloggers and brand-owners; but where is the value to the media players with long-standing brand relationships?

- A new teaching platform provider targets high school students who fall «behind»; but what is the product offering to their parents who pay?

Business modelling starts with a thorough grasp of which stakeholders to pay attention to – and what that means for target groups and segment definitions.

Step 2. Which are the important problems for each segment?

Customers pay to have their problems solved. A solution to a real problem triggers real buying decisions, value proposals without this usually do not!So the new app start-up needs to understand what support systems the accounting department requires; the blogger platform company should understand what value proposal makes the media players share their customer relationships; ... and the teaching provider must relate to the parents as a basis for their long-term customer relationship.

Step 3. What are the costs associated with the problems?

An unsolved problem can always be associated with a direct or indirect cost. Any efficiency loss may be calculated based on hard facts. Even a parent’s feeling of regret or their «bad conscience» for not having spent enough time with their kids can be translated into a possible financial consequence.Without this step the search for a business model will be like a blindfolded hunting party – with a minuscular chance of succeeding.

Step 4. What are the costs associated with the problems?

This critically important question is an illustrating example of the essence of early customer interaction; but what is the «correct answer»?There is no single right answer without extensive user testing and in-depth interviews, but some qualified hypothesis are actually available ...

Experience suggests that many B2C stakeholders may be willing to pay 10-20% of the «cost of a problem» to have it solved; i.e., up to 200 for an annual cost of 1.000. In B2B markets the willingness to pay is usually higher, depending on the nature of the costs or opportunity loss.

Step 5. What does it take to choose «you» vs. an alternative?

You probably thought you could skip this rather disturbing complication!Your competition includes direct rivalry, «no action», and anything in between – including all alternative uses of your customer’s resources. Add to that the non-trivial issue of switching costs and hidden «bonding» to a current solution provider, suggesting «status quo» as a very viable option.

Step 6. What are the value proposals for the target groups?

A well thought out solution with a quantified cost saving does not mean that the solution should necessarily be part of your value proposal. Maybe other problems are more critical, or maybe the «package» needs to handle the switching costs from step #5. Maybe the value proposal should include a very distinct deliverable to the parents in our teaching platform case example.The table below shows a 15 step algorithm (recipe) for developing high-quality business models

Step 7. What is your suggested pricing vs. value for step #6?

Applying your problem cost estimates does not make the pricing decisions trivial. Which elements trigger a buying decision and which may rather delay it? Is a free trial lesson the best pricing tool for the teaching platform start-up? Does a one time fee with lower fees per lesson work better? What about discounts for volume commitments? And how does your competitors price?The importance of pricing strategies is systematically underestimated and remain a weak area for many founders and experienced managers alike.

Step 8. What segments should be serviced based on your pricing and the potential customers’ willingness to pay?

Your pricing decisions are influencing the attractiveness of the target groups through their degree of willingness and ability to pay. Consequently, your pricing and ranking of the customer segments are not independent considerations. Rather, changes in pricing strategy should trigger the evaluation of what target groups to prioritize and in what sequence.Step 9. Which channels are effective towards the target groups?

This step represents a pitfall for most start-ups. The Internet may not be your primary sales channel if customers require lots of direct interaction to make a decision. Maybe the Internet is strictly for sales support; maybe a 3rd party channel is needed to facilitate a sale. Maybe a direct sales effort is needed.Step 10. What are the channels’ value proposals and margins?

The critical issue is the total cost it takes to trigger a buying decision.Even a customer sourced through the Internet may be prohibitively expensive due to high social media costs combined with a low probability of buying.

Margins for conventional channels vary from approx. 10-15% for «agents» up to 50% in retailing; with online retailing around 30%. Direct sales is rarely attractive unless the net present value of a new customer exceeds ~10 kUSD.

Step 11. What target groups are attractive based on step #10?

It is useless to evaluate profitability without looking at channel costs. The most attractive channels from step #9 are not necessarily the best after taking the margin and servicing costs of step #10 into consideration.And how does the target group attractiveness look now, in view of the pricing decisions of step #7 (taking into consideration the willingness to pay) and the servicing costs of step #10 (including the channel margins)?

Step 12. Is the pricing strategy of step #7 stable after 9, 10, 11?

Can the application be priced at 9 USD/month if it costs 100 USD to close a sale? Is it necessary to reconsider the pricing (step #7), the channel strategy (step #9) or both? Maybe the value proposition need to be reduced (step #6)? Does it make sense to prioritize another customer segment with a higher willingness to pay (step #8)?When servicing costs are inconsistent with the initial pricing, several rounds of iteration between the combinations of pricing, channels, segments and value proposals may be necessary before reaching a stable conclusion.

Step 13. What is the accessible financial potential?

Having reached a stable conclusion in step #12, a calculation of the financial potential represented by the steps #6 - #11 may now be completed – offering a picture of the total theoretically accessible economic potential of the business model. This potential should be expressed as both an aggregate and annual number (with some transition pitfalls between the two).Step 14. Is the business case sufficiently interesting with a realistic market share in a relevant geographical area?

Basing a conclusion of the business model on the financial potential from step #13 is subject to three misjudgments. The first is to wrongly assume a too high portion of the market as being accessible to new entrants.The second is to assume an unrealistically high share of the accessible market, which should rarely exceed 15%.

The third misjudgment is usually to assume a too high and too early international share of sales in order to verify a «high potential». International ambitions are important. The unrealistic part is to assume international break-throughs before having thoroughly succeeded closer to home. Business plans implicitly assuming international success in order to reach breakeven numbers are plainly not sufficiently attractive.

Step 15. Is your business model hypothesis stable?

A satisfactory potential with a 15-20% share in an accessible market «close to home» is a balanced approach indicating that the business model is stable and of high quality. If not, you are back to the drawing board – e.g., to step #6 (value proposal), or even earlier, e.g., if the stakeholders (step #1) and their problems (step #2) have not been sufficiently well understood.A perspective on high-quality business modelling

The key to high-quality business model design is to understand how the value proposals towards the prioritized target groups should create sufficient value for the pricing to generate profits – provided the channel costs for reaching these relevant target groups. The model should have a sufficiently attractive potential with a maximum 15-20% market share in a «close-to-home» geographical area. The rest is icing on the cake!This logic should form the basis for start-ups and new business cases; the other parts of the business plan being consequences of this basic premise.

For a full pdf version of this article, see White Paper #9: A 15 Step Recipe for Developing Your High-Quality Business Model.

Other Relevant Articles

Also read the separate articles on

Strategy and the proper use of M&A; on

Strategic Alliances and Joint Ventures; on

Synergies and Poor Judgment; on

Financial vs. Industrial Ownership; and on

Strategy Implementation and the Lack of Results.

See Download Center:

White Paper #1:

Post-Merger Integrations - About Synergies and Poor Judgment;

White Paper #2:

Strategy - and the Proper Use of M&A Tools;

White Paper #3:

Strategy and Implementation - and the Lack of Results;

White Paper #5:

Buy-Side M&A (mergers and acquisitions);

White Paper #6:

Sell-Side M&A (divestitures, trade-sales and mergers);

White Paper #7:

Should You Choose Financial or Industrial Investors/Owners?; or

White Paper #8:

Equity Based Financing of Start-ups and High Growth Situations.