Buy-Side Mergers and Acquisitions (M&A)

Implementing buy-side M&A acquisition processes represent high risk initiatives with well-defined success factors and high probabilities for making costly mistakes. Most companies should first consider alternative options for growth!

This article is based on this one discussing General M&A.

I will also recommend you to first read the one on

Strategy and the Proper Use of M&A.

This article is available in a full pdf version.

Basic considerations before initiating an acquisition process

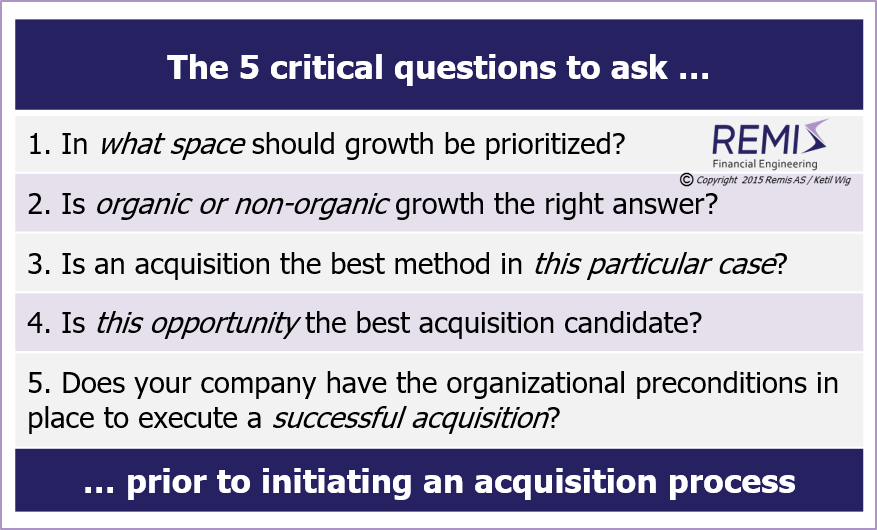

Based on approximately 35 years of experience with ~ 150+ buy-side transactions, my assertion is that the strategic reasoning of your organization should probably be challenged first - relating to one or more of the following 5 questions:- In what space should growth be prioritized?

- Should growth be organic or non-organic?

- Is an acquisition the best option in this situation?

- Is the identified target the best acquisition candidate?

- Does your company have the organizational preconditions in place to execute a successful acquisition or merger?

These five questions should clearly demonstrate the profound link between buy-side M&A and the domain of corporate and business unit strategy, and why this link is especially relevant for the implementation of growth strategies.

So what alternatives should you consider first?

In what space should growth be prioritized?

Many acquisition processes are initiated as the result of an M&A advisor introducing a sell-side opportunity to prospective buyers.That is a wrong starting point!

As both financial and operational risk (see post-merger integrations) is especially high for acquisitions, it is particularly important with objective prior analysis. A hastily developed growth strategy as a consequence of reacting to a sell-side opportunity has the uncomfortable tendency to be “colored” by the process - particularly regarding the optimal use of capital resources.

The psychology is somewhat similar to the acquisition motives found in corporations with relaxed corporate governance structures, where drivers for influence and compensation may be “effectively competing” with the objective of maximizing ownership returns.

In an objectively developed growth strategy the options compete for optimizing customer access, growth and returns vs. minimum risk and capital employment. The resulting path-of-least-resistance should increase (or as a minimum maintain) the quality of the strategic position and revenue portfolio. An acquisition candidate should win this benchmarking in order to constitute the preferred growth alternative.

Develop an objective growth strategy before considering specific acquisition opportunities

Should growth be organic or non-organic?

Organic growth alternatives are often underrated, mostly due to underestimating the revenue potential in the existing customer base. Managers consistently overrate their perceived knowledge of how their companies compete. Thirty years of experience with comparing the results of in-depth customer interviews with preconceptions, verify a significant perception gap.In fact, I have never actually executed a set of such interviews, where the results have not challenged the client's existing view on precisely how the customers perceive competitive strength and the where and how of future growth! ... which should clearly demonstrate the importance of not solely basing growth strategies on the preconceived opinions of top management.

So, precise knowledge on how to compete and consequently on how to increase share-of-wallet is a strong driver for organic growth options. In addition, the incremental capital and operational investment in order to tap this organic potential are usually significantly lower than for executing "external" growth alternatives such as acquisitions.

Evaluate options for organic growth, including "share-of-wallet" potentials vs. the incremental risk and necessary investments for acquisition alternatives

Is an acquisition the best option in this particular situation?

M&A strategies are generally poorly understood; particularly when considering acquisitions vs. alternative methods.An acquisition should be on the “tool list” for expanding a business when ...:

- Barriers-to-entry are significant

- Speed is essential

- Customer loyalty is high

- Alternative options are limited

The challenge is that many managers are claiming such rational arguments without facts - and usually also without seriously considering alternative entry strategies, e.g. doing it organically, entering into a strategic alliance (partnership structure without ownership), or forming a joint venture with shared risk and capital commitment. For more on this subject, read this article on Strategic Alliances and Joint Ventures.

As an acquisition is usually the option carrying the maximum risk, it is also the alternative which mostly deserves a careful comparison with lower risk initiatives.

Make a thorough screening of lower risk alternatives to an acquisition

Is the identified opportunity the best acquisition candidate?

The right starting point for handling an acquisition opportunity, is not only about it being based on an objective growth strategy or to cut through biased opinions vs. facts - it is equally relevant to design the acquisition process in a way which allows for the evaluation of alternative options along the way.This is far from trivial, as a sell-side divestiture process is usually designed with the opposite in mind – usually with milestones and procedures in place to limit the prospective buyers' flexibility for comparing the opportunity with available alternatives.

Such pre-arranged sell-side processes present challenges for most unprepared buyers, and require long-term tactical buyer experience in order to not lose out on the original opportunity. The consequence of missteps may be that your main competitor ends up with an irreversibly better strategic position.

Make certain that the acquisition process allows for evaluating alternative options and acquisition targets

Are the organizational preconditions in place to execute a successful acquisition or merger?

The biggest challenge in making acquisitions is not to acquire – it is to successfully handle the acquired entity with strategic insight, speed and sensitivity to organizational challenges.

A number of high impact and critical pitfalls are associated with this theme. The fundamental issue is that most managers do not recognize how critical the post-merger integration process is to the overall success of an acquisition. The tendency is to simplify the PMI agenda (“yes, of course”) rather than to dedicate enough attention and resources to the detailed planning of the integration.

Synergies should not be highest on the critical issue list – they always get enough focus together with the associated financial themes anyway. Gaps rather materialize around the subjects of corporate culture, key personnel and organizational redesign. The M&A industry has more than enough hard facts to document success and failure originating from such non-financial agenda items. However, despite decades of documenting these well-known observations, the pitfall of lack-of-adequate-integration still remains on top of the list for explaining sub-standard acquisition returns.

Dedicate sufficient attention and resources to the post-merger integration process

And then ... about the acquisition process itself

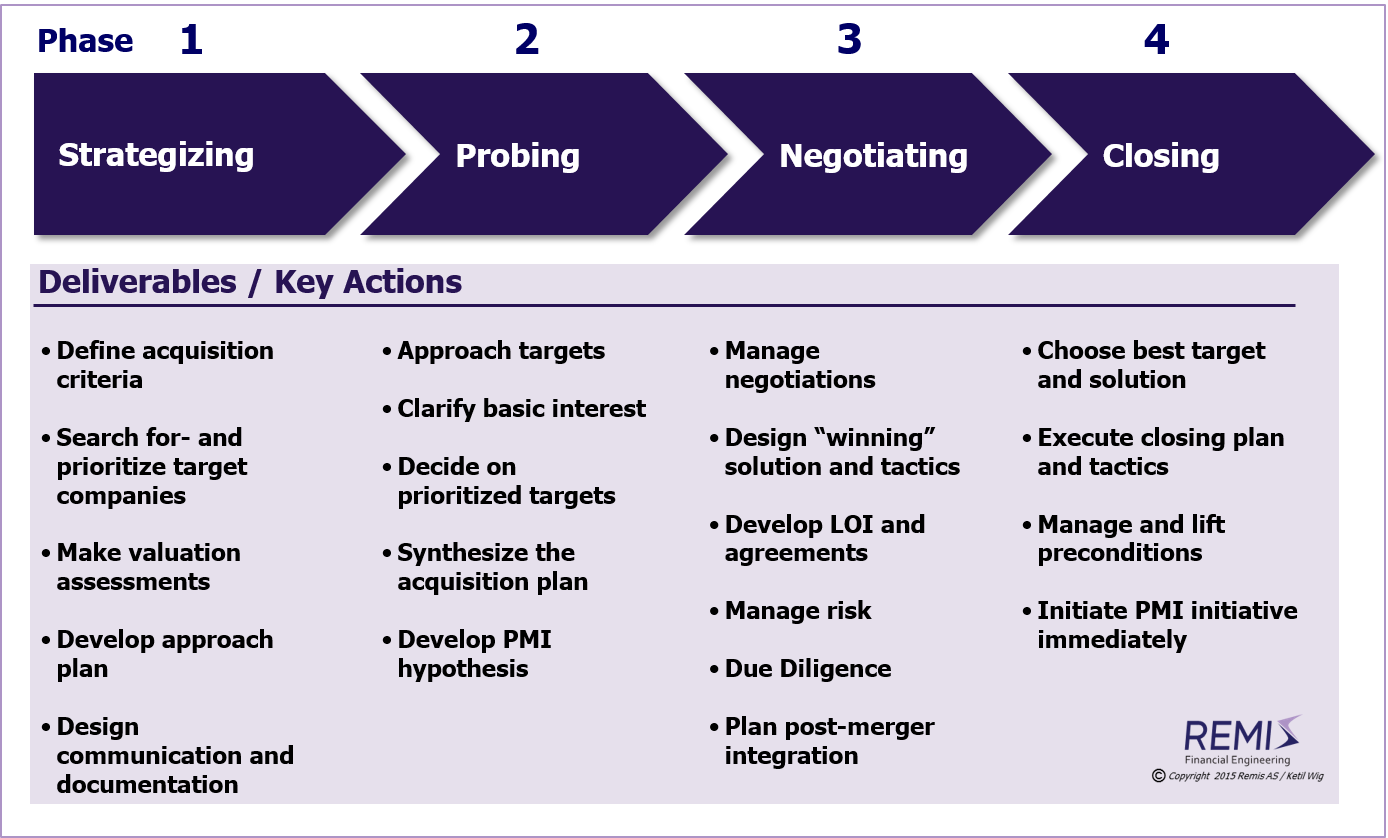

With the above mentioned 5 quality assurance filters in place, it is time to introduce the acquisition process and its key phases and steps.So here is your expected process chart:

Negotiation strategies and tactics are subject areas in their own right and not covered in this article. On the Norwegian version of this web site (here) you will find a series of 13 white papers (not yet translated into English) coving a complete framework for general negotiation and tactics.

However, beyond negotiations and tactics the 3 key success factors of acquisition processes are in my opinion:

Success factor #1: Preferred buyer advantage:

A structured acquisition process is a buyers' competition - usually with an intensity proportional to the attractiveness of the acquisition target. Price and “terms” are the simple parts (... although, not always so ..!). As in other buyer situations with multiple parties, it is necessary to seek out buyer advantages. Developing “creative solution elements” always makes sense based on the specifics of the buying entity and the sell-side situation, but all such deal elements must be positioned and communicated directly towards those among the seller's decision makers who are truly concerned with deal quality beyond plain price and terms. These relationships are always important, but sometimes they are decisive - particularly in situations when other factors are close to being identical.Success factor #2: Approach sequence:

The best sequence for approaching alternative acquisition targets is in "reversed prioritized order", i.e. starting with the least promising candidates. The rationale is to learn about motives, industry trends and the competition - before actually meeting their competitors later in the process. This approach creates asymmetric information advantages vs. the seller and the most promising candidates.Success factor #3: Early post-merger integration planning:

When the deal is closed, the 90 day integration plan should be ready. This is a radically different approach than that of most acquirers, but it is a crystal clear success factor for experienced buyers. The consequences are numerous, such as an integration team working in parallel with the financial and due diligence resources. In addition, this approach challenges the typical sell-side phase design as it necessitates early access to the organizational resources of the seller. This typically means settling the financial terms early during the acquisition process, often also requiring the execution of a Letter-of-Intent.The reason why I have left out risk management from the above success factors, is because the primary risk reduction strategy is implemented through a best possible execution of the post-merger integration. The remaining risk is to a large extent handled through the "due diligence" and the negotiation elements concerning mechanisms for limiting risk, including the quality of legal documents. These are very important elements, but they are closer to the subject of negotiations than to the basic understanding of how the acquisition process works and should be properly handled.

A similar type of reasoning is linked to the question of whether an LOI (Letter-of-Intent) should be used - usually tied to a claim for exclusivity by the buyer. This consideration is a stand-alone assessment of which negotiation tactics are best suited to a particular situation. Some times exclusivity enhances the buyer's position, other times not. Normally the seller will seek to lock in “acceptable terms” in order to accept time-limited exclusivity, which by no means makes exclusivity an obvious choice for the buyer. A process without exclusivity may be preferable in cases when the buyer tactic is to delay the process, e.g. due to alternative targets or because it is considered better not to lock in “terms” early during the acquisition process. An example of such preferences may be in situations with few perceived buyers and when the plan is to achieve significantly better terms through the upcoming due diligence fact-finding mission.

Buy-Side M&A in Brief

The primary factor in ensuring buy-side M&A success is to decide when not to make acquisitions. The second is to adequately plan for the post-merger integration early enough during the process. Thirdly, the right approach tactics towards alternative targets combined with a deep understanding of risk management will get you a long way.For a full pdf version of this article, see White Paper #5: Buy-Side M&A (mergers and acquisitions).

Other Relevant Articles

Also read the separate article on

M&A strategy, on

Strategic Alliances and Joint Ventures, on

Sell-Side M&A, on

Synergies and Poor Judgment, on

Financial vs. Industrial Ownership, on

Equity Based Financing of Start-ups, and about

M&A Process Management.

See Download Center:

White Paper #2:

Strategy - and the Proper Use of M&A Tools.

A LinkedIn article with a shorter web version of the same white paper is available

here;

White Paper #6:

Sell-Side M&A (divestitures, trade-sales and mergers); or

White Paper #7:

Should You Choose Financial or Industrial Investors/Owners?; or

White Paper #8:

Equity Based Financing of Start-ups and High Growth Situations.