Sell-Side Mergers and Acquisitions (M&A)

While buy-side M&A processes (acquisitions) are focused on alignment of strategy, integration and risk management; the sell-side M&A (divestitures and trade-sales) skill set is concentrated around negotiations and tactics.

Prior to reading this article I recommend that you read about General M&A, ans this one on Strategy and the Proper Use of M&A. On the Norwegian web site you will find a series of 13 white papers (not yet translated into English), coving a complete framework for general negotiation and tactics (here).

This article is available in a full pdf version.

Sell-side and buy-side M&A are obviously different, but this difference goes deeper than most managers realize. For acquisition processes (see this article on Buy-side M&A ), strategy alignment, post-merger integrations, approach tactics and risk management are keys to success.

For divestitures and trade sales the strategic themes are secondary (although by no means irrelevant), and negotiations and tactical skills are primary success factors.

While the negotiation strength of the buyers in an acquisition process is influenced by such factors as alternative acquisition targets and their options for delivering growth (including e.g. organic growth, strategic alliances etc.), it is the seller in a sell-side transaction who to a large extent defines the landscape of negotiation - and the primary tool is the number of qualified buyers.

When the decision to divest a business has been made, the obvious objective of the seller is to maximize price and terms. Consequently, the key issue becomes how to create a buyers' competition within a defined time window. This translates into negotiation and tactical skills as the primary focus of competence.

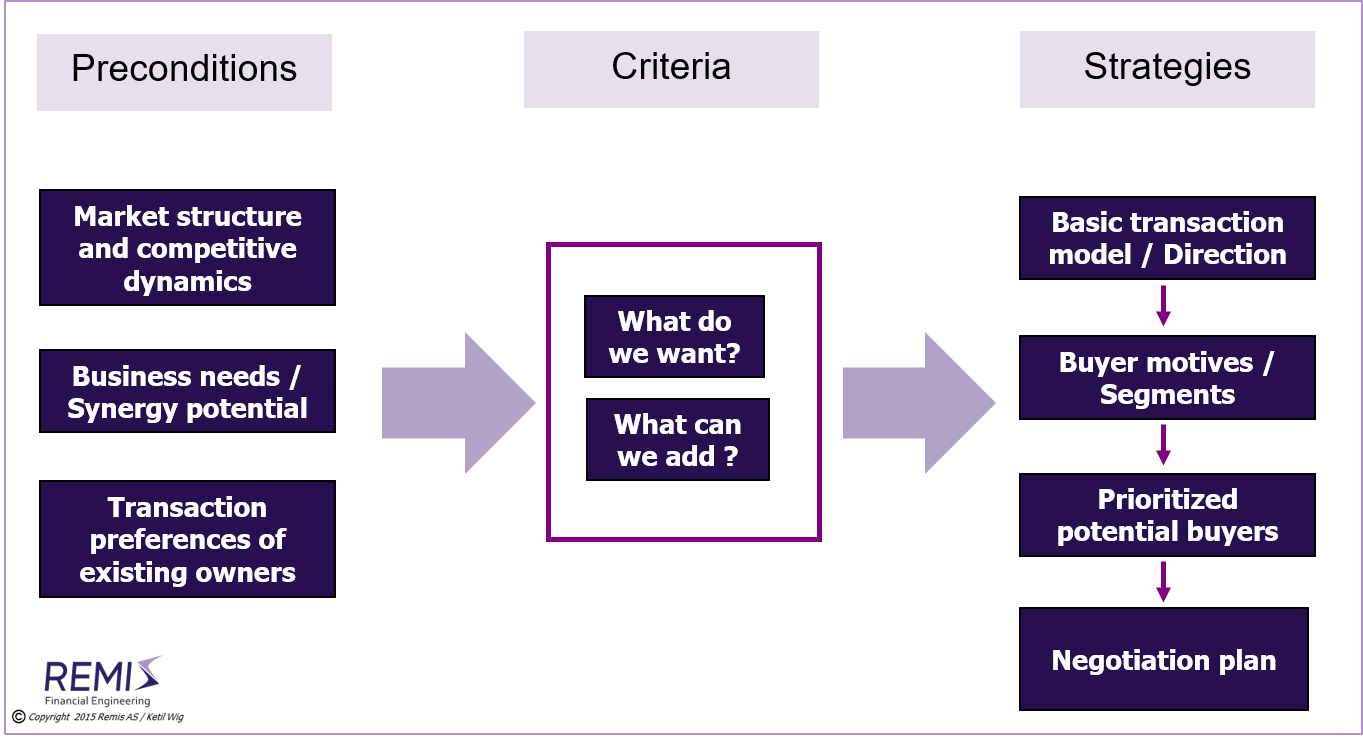

But before discussing the divestiture process further, first some words on what role strategy plays on the sell-side of an M&A transaction (see illustration #1 for a framework on sell-side M&A strategy).

The role of strategy in divestitures and trade sales

The strategic drivers when executing a sell-side transaction (excluding valuation metrics etc.) are focused around three factors:- Market structure and industry trends

- Synergy potential towards potential buyers

- Transaction preferences of existing owners

These drivers strongly influence sell-side factors such as timing, relevant buyer segments and motives, and the value proposition towards potential buyers.

Market Structure and Industry Trends:

Changing preferences of how customers select their suppliers, e.g. a movement towards fewer and larger supply chain players, represent changes in the delivery chain that may trigger ideas for potential acquirers.Both horizontal and vertical value chain integration trends represent a base for buyer motives and timing. Such developments may result in an initial transaction, which then may set off a consolidation wave involving multiple players. This type of market dynamic occurs relatively often, and may open up a well-defined time window for deciding when to initiate sell-side M&A initiatives.

The timing of divestitures is also to a high degree influenced by business cycles and the condition of the financial markets. Usually it takes 6-9 months to complete a sell-side transaction, and more like 9-12 months when international buyers are involved. For a multi-step transaction (where ownership is transferred in e.g. 2-3 steps), the total process may endure for 18-24 months. With business cycles typically moving upward for 4-5 years (and downward for 2-3 years), these observations indicate distinct starting points for the timing of sell-side M&A processes.

Synergy Potential Towards Potential Buyers:

The selection of potential buyers to a sell-side M&A process should not only include the “obvious candidates”, but also be based on how the company may create value for its new owners. The elements of such value creation depend on the choice of perspective, e.g. market share, product portfolio range, cost position, supply chain characteristics, etc. The seller then translates these perspectives into buyer motives. Buyer motives are the basis for the prioritization of potential buyer groups and the choice of which arguments are best suited for each group.Buyer motives are the basis for synergy calculations. A seller is not always successful in translating such synergies into a higher price tag for the business (this depends on such non-controllable factors as the buyer's alternatives), but synergies always represent a key segmentation and communication tool for bringing prospective buyers to the negotiation table.

Transaction Preferences of Existing Owners:

Transaction preferences of sellers typically include such criteria as minimum cash payments, single vs. multi-step transaction models, lock-up claims for management, valuation characteristics, and whether or not merger solutions are acceptable (with settlement in the buying entity's shares). Some of these criteria will represent “yes” or “no” decisions (e.g. if a merger is acceptable), while others are typically more flexible (e.g. transaction steps and minimum cash settlements). These preferences represent implicit drivers for deciding on the elimination of certain buyer groups, while moving others to the top of the list.The above 3 factors illustrate the role of strategic reasoning in sell-side transactions. Strategy is certainly not of immaterial value, but its use is primarily concerned with prioritizing prospective buyer segments and to substantiate the level of synergies between the buyer and seller during the negotiations.

Valuation and the importance of growth as a value driver

Price is the primary deciding factor for any seller. The challenge in the valuation of a company is not in agreeing on the consequence of its financial history, but rather to establish reliable estimates for future years and to understand the different risk perceptions between buyer and seller.Everyone having built a net present value model of discounted cash flows is aware of the strong sensitivity of the result in relation to growth preconditions. Consequently, the development and documentation of a well-founded growth strategy is a key factor in arriving at high multiples and valuations. The ability to create credibility around a growth plan is therefore a central theme to any sell-side negotiation.

Buyers have a different (and often well-founded) view on risk factors, but this perspective has a tendency to be underestimated by the sell-side. Take as an example a buy-side concern for losing customers or suppliers. For the seller such concerns may be “noise”, whereas the buyer may be genuinely concerned about a consolidation trend in a B2B customer base or a forward integration development in the supply chain.

Considerations of financial vs. industrial buyers

A special sell-side consideration is whether the buyer should be “financial” or “industrial”.This is an important theme, so let's review it.

The below chart illustrates the drivers of the sell-side M&A process.

Financial buyers

are temporary owners; they acquire a company with the purpose of developing shareholder value and then reselling it to new owners. This approach represents advantages for existing owners in situations where there is an untapped value potential which cannot be translated into a higher price in the initial transaction. The primary disadvantages of financial ownership may include a different culture and set of values, and the fact that the future ultimate owner is unknown at the time of the initial sale.On the positive side, a partial sale to a financial owner is usually without conflicts-of-interest as both the existing and new financial owners share the objective of reselling the company in a future transaction with a higher price tag.

Industrial buyers

are driven by different motives. They acquire companies with the primary objective of realizing the synergy potential between the acquired entity and their own value chain. The advantages include a focus on the speed and quality of the integration, and the fact that industrial buyers usually represent permanent ownership.Generally speaking, a financial buyer prefers partial ownership (varying from minority positions up to e.g. 75% for private equity) whereas industrial buyers require full ownership. However, and rather ironically, industrial owners still often require multi-step acquisition models for reducing risk, which is not consistent with post-merger integration agendas. In addition, multi-step acquisitions have built-in conflicts-of-interest towards remaining minority owners because the industrial buyer ultimately wants full ownership at a lowest possible price. Such transaction designs therefore require special risk-reducing mechanisms for the selling shareholders, protecting against tactical behaviors in the later steps of the ownership transfer.

For more on this theme read this in-depth article on the characteristics of Financial vs. Industrial Ownership.

Considerations of structured auctions vs. alternative sell-side process designs

Most sell-side divestiture processes are organized as structured auctions. Buyers present their indicative bids based on pre-determined timing constraints, which are then processed by the seller and which form the basis for final negotiations with a limited set of preferred buyers – sometimes 3-4; other times only one.Over time the M&A industry has developed this into a standard way of handling sell-side transactions. However, this is certainly not the only answer to the question of how divestitures may be managed. As an example of the need for a different approach, consider the agenda of an industrial buyer. They are concerned with understanding synergies and how they should handle the post-merger integration effectively. Such evaluations are complex and of a completely different nature than those of private equity buyers, and they consequently require a different timeline. Large corporations may also have policies whereby they plainly refuse to participate in structured auctions, which work best in situations with many uniform prospective buyers.

Process designs combining financial and industrial buyers are therefore complex and may involve an interlinked set of multiple phases based on different work principles guiding each phase.

And then ... about the divestiture process itself

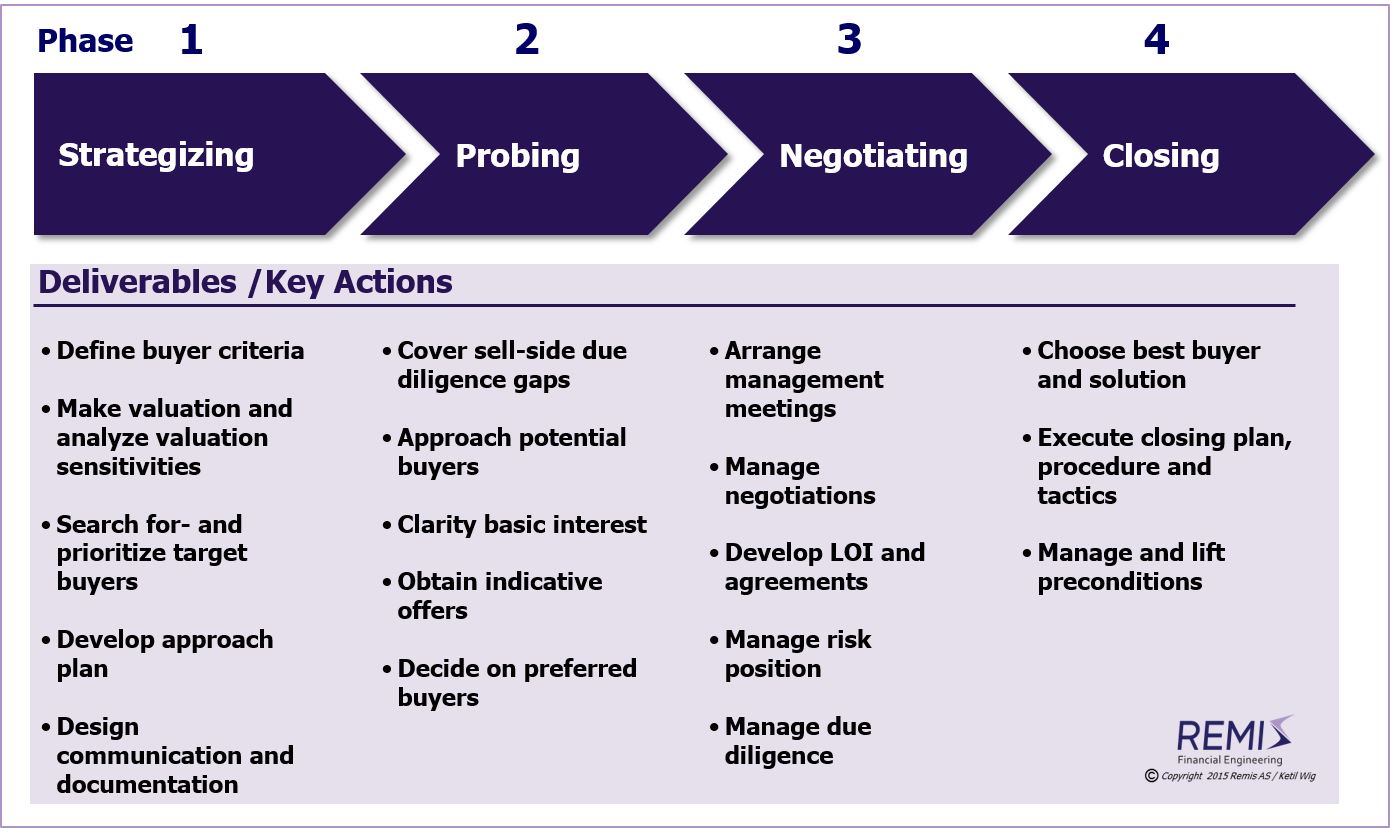

A typical M&A divesture process is divided into the following phases and steps:

The key success factors of divesture processes are:

- Having enough potential buyers

- High-level negotiation and tactical skills

Success factor #1: Enough potential buyers:

A successful sell-side M&A project with satisfactory price terms can almost always be traced back to an initial condition of having started out with enough potential buyers. Pure luck certainly plays a role in M&A processes as in any other implementation of a business development agenda, but that aside – usually a well-managed sell-side M&A process should start with a minimum of 25 (or more) qualified parties.Potential buyers drop out for a number of natural reasons as the sell-side M&A process develops: wrong timing, focus on other priorities, management changes, reduced capital resources - as well as for a number of other reasons.

And that is prior to price negotiations!

Success factor #2: Negotiation and tactical skills:

As initially mentioned, negotiation and tactical skills play a significant role in sell-side M&A. On the Norwegian version of this web site (here) you will find a series of 13 white papers (not yet translated into English) coving a complete framework for general negotiation and tactics.Sell-Side M&A in Brief

While buy-side M&A processes (acquisitions) are focused on the alignment of strategy, integration and risk management; the sell-side M&A skill set (divestitures and trade-sales) is concentrated around negotiations and tactics. Supporting success factors focus on understanding business cycle timing, developing and documenting growth plans, and the ability to communicate synergies towards potential buyers.For a full pdf version of this article, see White Paper #6: Sell-Side M&A (divestitures, trade-sales and mergers).

Other Relevant Articles

Also read the separate article on

M&A strategy, on

Strategic Alliances and Joint Ventures, on

Buy-Side M&A, on

Synergies and Poor Judgment, on

Financial vs. Industrial Ownership, on

Equity Based Financing of Start-ups, and about

M&A Process Management.

See Download Center:

White Paper #2:

Strategy - and the Proper Use of M&A Tools.

A LinkedIn article with a shorter web version of the same white paper is available

here;

White Paper #5:

Buy-Side M&A (mergers and acquisitions); or

White Paper #7:

Should You Choose Financial or Industrial Investors/Owners?; or

White Paper #8:

Equity Based Financing of Start-ups and High Growth Situations.