Financial and Operational Restructuring

Restructurings are often crisis-oriented projects involving radical changes and redesign to corporate balance sheets, corporate structure, business portfolios, capital structure and financing. This is why project tools such as valuations represent a necessary part of a typical restructuring.

Read this article on: Choosing Financial vs. Industrial Owners.

Restructurings vs. Turnarounds

Many restructuring projects (with balance sheet redesign) have simultaneous turnaround characteristics (including P&L/operational redesign), but not all. For example, some companies may have restructuring requirements concentrated to loan portfolios or corporate structure without significant impact on day-to-day operations.Restructurings as a Strategic Change Tool

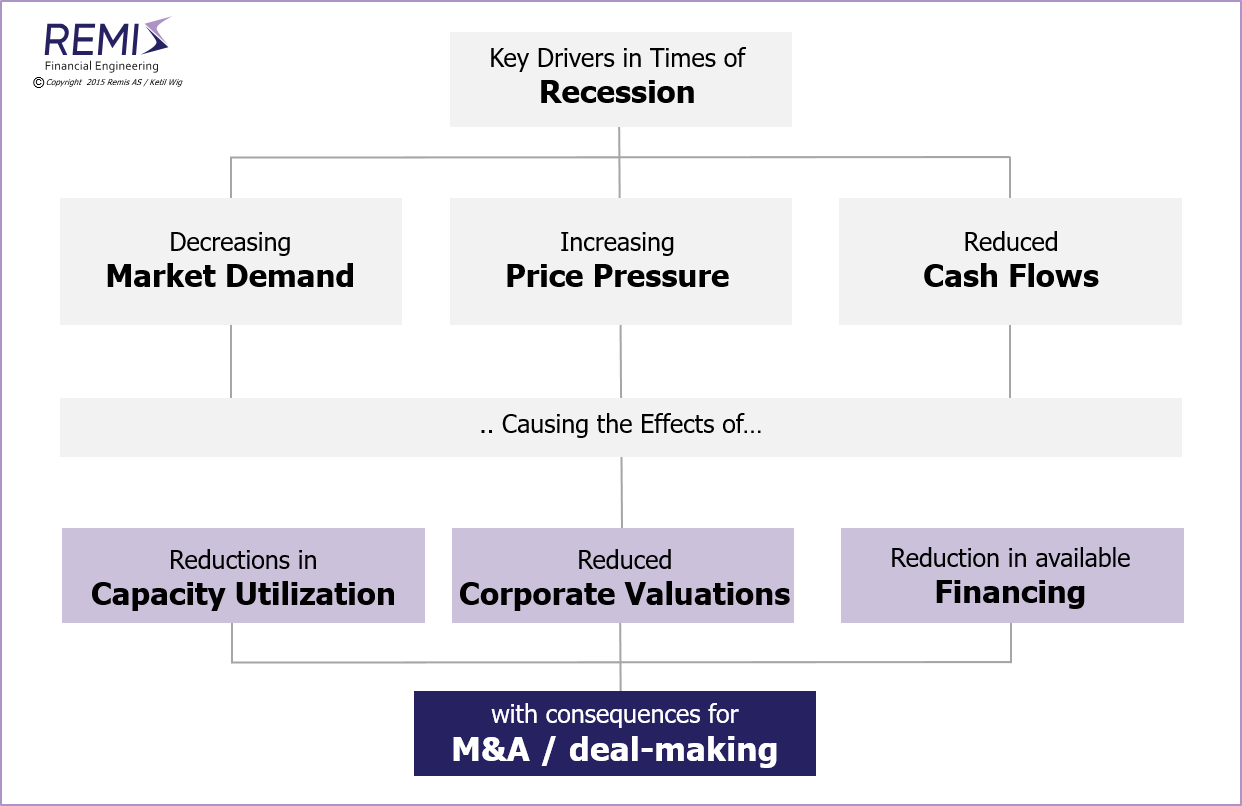

Restructurings are also on the agenda when a company changes its core strategy and consequently wants to spin-off or divest a company or business unit. This may require a complex re-allocation of assets – or changes in production strategy, suppliers, financing or capital structure – which include many elements of a full restructuring. A de-merger has the same characteristics.The below illustration shows how the effects of recessions drive the second order consequences which typically initiate the need for restructurings: low capacity utilizations, low corporate valuations and unavailable financing.

Project management of restructurings typically requires the balancing of interests between various stakeholder groups such as owners, creditors and banks/corporate lenders.

Other Relevant Articles

Also read the separate articles on

Strategy Implementation and the Lack of Results, on

Developing High Quality Business Models; on

Strategy and the Proper Use of M&A Tools, on

Buy-Side M&A, on

Sell-Side M&A, on

Synergies and Poor Judgment, on

Financial vs. Industrial Ownership, on

Equity Based Financing of Start-ups, and on

M&A Process Management.

See Download Center:

White Paper #1:

Post-Merger Integrations - About Synergies and Poor Judgment;

White Paper #3:

Strategy and Implementation - and the Lack of Results;

White Paper #5:

Buy-Side M&A (mergers and acquisitions);

White Paper #6:

Sell-Side M&A (divestitures, trade-sales and mergers); or

White Paper #7:

Should You Choose Financial or Industrial Investors/Owners?;

White Paper #8:

Equity Based Financing of Start-ups and High Growth Situations; or

White Paper #9:

A 15 Step Recipe for Developing Your High-Quality Business Model.